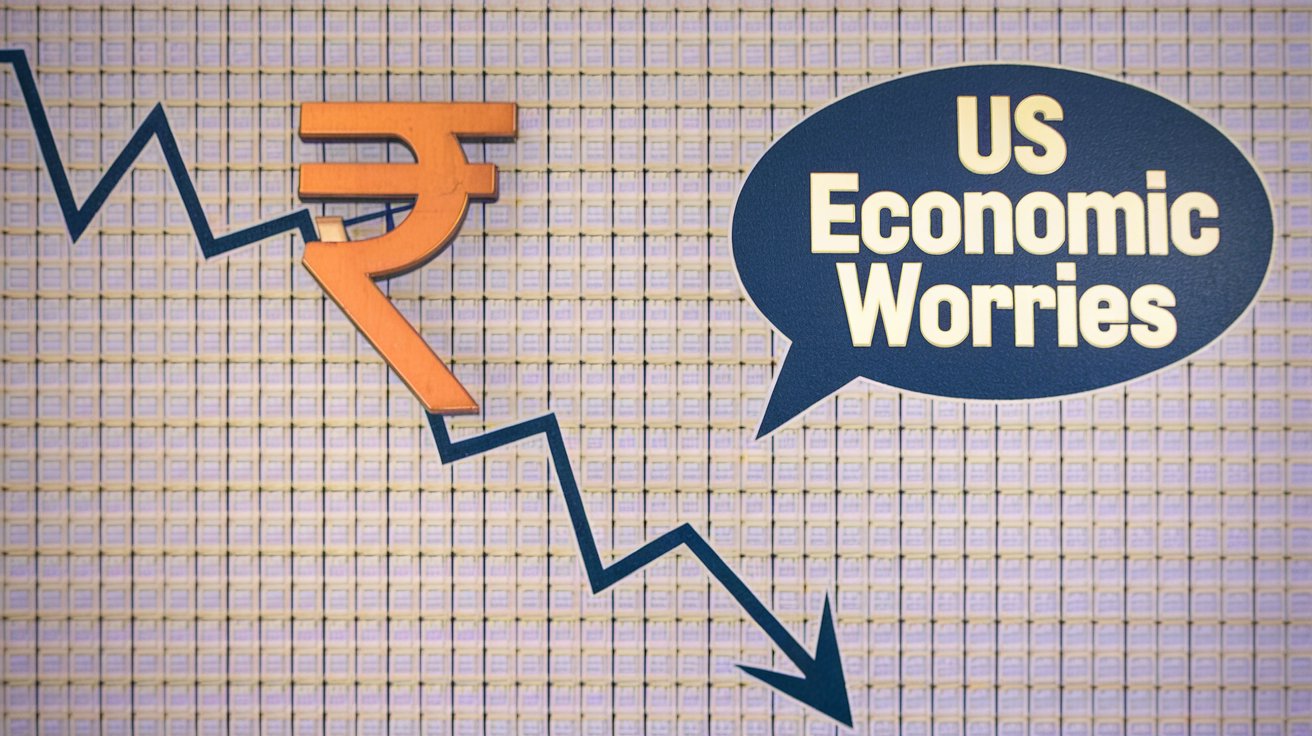

Rupee Under Pressure Due to US Economic Worries: Causes, Impact, and Future Outlook

Introduction

The Indian rupee has been under significant pressure due to growing concerns over the U.S. economy. The fluctuations in global financial markets, interest rate decisions by the U.S. Federal Reserve, and international trade policies have had a direct impact on the rupee’s value against the dollar. Since India heavily depends on imports, a weak rupee can have significant economic consequences, including inflation and increased borrowing costs.

Over the past few months, the rupee has been witnessing a downward trend due to external factors such as rising U.S. interest rates, capital outflows from emerging markets, and a global economic slowdown. Domestically, factors like rising crude oil prices, a widening trade deficit, and foreign portfolio outflows have also played a role in the rupee’s depreciation.

In this article, we will analyze the key reasons behind the rupee’s decline, its impact on the Indian economy, and the possible future trends. We will also explore how businesses and individuals can navigate these economic uncertainties while discussing government measures to stabilize the rupee.

Table of Contents

ToggleWhy is the Rupee Under Pressure?

Several factors are contributing to the weakening of the Indian rupee. Some of the most prominent ones include:

1. U.S. Federal Reserve’s Monetary Policy

One of the biggest reasons behind the rupee’s weakness is the U.S. Federal Reserve’s aggressive stance on interest rates. The Federal Reserve has been increasing interest rates to combat inflation in the U.S. This has led to a stronger dollar as global investors shift their investments to U.S. assets for higher returns. As a result, capital outflows from emerging markets, including India, have put downward pressure on the rupee.

2. Economic Slowdown in the U.S.

The U.S. economy is facing a slowdown, and concerns over a possible recession have affected global markets. As the world’s largest economy, any uncertainty in the U.S. impacts investor confidence, leading to increased demand for the U.S. dollar as a safe-haven asset. This higher demand for dollars has further weakened the rupee.

3. Rising Crude Oil Prices

India is one of the largest importers of crude oil, and rising global oil prices have a direct impact on the rupee. Since crude oil is purchased in dollars, a weak rupee increases the cost of oil imports, leading to a higher trade deficit. This, in turn, puts additional pressure on the rupee.

4. Foreign Portfolio Outflows

Foreign Institutional Investors (FIIs) play a crucial role in India’s financial markets. However, when global economic uncertainty rises, investors pull their money out of emerging markets like India and invest in safer assets like U.S. Treasury bonds. This capital outflow weakens the rupee further.

5. Trade Deficit and Current Account Deficit

India’s trade deficit, which occurs when imports exceed exports, has been increasing. A high trade deficit means India needs more dollars to pay for imports, which depreciates the rupee. The current account deficit (CAD) has also been widening, indicating that India is spending more foreign currency than it is earning, further contributing to rupee depreciation.

Impact of a Weak Rupee on the Indian Economy

The depreciation of the rupee against the U.S. dollar has both positive and negative effects on the Indian economy.

1. Increased Inflation

A weaker rupee makes imports costlier, particularly crude oil, electronic goods, and essential commodities. As import costs rise, businesses pass on these expenses to consumers, resulting in higher inflation. The cost of living increases, and households feel the financial strain.

2. Higher Cost of Borrowing

Many Indian companies rely on external borrowings in foreign currency. A weak rupee makes it more expensive to repay these loans, leading to financial stress for businesses. Higher debt servicing costs can impact corporate profits and economic growth.

3. Pressure on Forex Reserves

The Reserve Bank of India (RBI) intervenes in the foreign exchange market by selling dollars from its forex reserves to stabilize the rupee. However, excessive intervention can deplete these reserves, reducing the country’s ability to manage future currency fluctuations.

4. Boost to Exporters

A weaker rupee makes Indian goods and services cheaper for foreign buyers. This benefits exporters in industries such as IT, textiles, and pharmaceuticals as their products become more competitive in global markets. However, this advantage is only effective if global demand remains strong.

What Can Be Done to Stabilize the Rupee?

1. RBI’s Intervention in Forex Markets

The RBI plays a crucial role in stabilizing the rupee by using its forex reserves to manage excessive volatility. While this helps in the short term, it is not a permanent solution, as excessive intervention can reduce reserves.

2. Attracting Foreign Investments

India needs to attract more Foreign Direct Investment (FDI) and Foreign Institutional Investment (FII) to counterbalance capital outflows. Favorable policies and economic reforms can encourage foreign investors to invest in India, strengthening the rupee.

3. Promoting Export Growth

Encouraging export-oriented industries can help increase foreign exchange earnings. Government initiatives to support exporters through incentives, tax benefits, and subsidies can contribute to strengthening the rupee.

4. Reducing Dependence on Imports

India should work towards reducing its reliance on imported goods, particularly crude oil. Investing in renewable energy, increasing domestic oil production, and promoting local manufacturing can help reduce the trade deficit.

5. Strengthening Domestic Economic Policies

A stable macroeconomic environment, sound fiscal policies, and economic reforms can boost investor confidence and help the rupee regain strength.

Future Outlook: Will the Rupee Recover?

The future of the rupee depends on multiple factors, including global economic conditions, U.S. monetary policies, and India’s domestic economic reforms.

- If the U.S. Federal Reserve slows down its interest rate hikes, the pressure on the rupee may ease.

- A revival in global trade and economic growth could stabilize the currency.

- Government initiatives to boost foreign investments and strengthen domestic industries will play a crucial role in stabilizing the rupee.

While short-term volatility may continue, India’s strong economic fundamentals and policy measures could help the rupee recover over time.

Conclusion

The Indian rupee remains under pressure due to economic concerns in the U.S., rising crude oil prices, and foreign capital outflows. A depreciating rupee has both positive and negative implications for India’s economy, affecting inflation, trade, and investments.

To stabilize the rupee, India needs to focus on attracting foreign investments, promoting exports, and reducing import dependence. While short-term challenges persist, India’s long-term economic growth prospects remain strong. With strategic economic policies, the rupee could regain stability in the future.

FAQs (Frequently Asked Questions)

1. Why is the Indian rupee falling against the U.S. dollar?

The rupee is falling due to factors such as the U.S. Federal Reserve’s interest rate hikes, foreign investment outflows, rising crude oil prices, and a widening trade deficit.

2. How does a weak rupee affect common people?

A weaker rupee increases inflation, making imported goods like fuel, electronics, and essential commodities more expensive. This raises the cost of living for the average consumer.

3. Will the rupee recover in the near future?

The rupee’s recovery depends on global economic conditions, India’s trade balance, and government policies. If the U.S. slows interest rate hikes and India strengthens its economy, the rupee may stabilize.

4. What role does the RBI play in stabilizing the rupee?

The RBI intervenes in forex markets by buying or selling dollars to manage rupee fluctuations. It also implements monetary policies to control inflation and ensure financial stability.

5. How can India reduce its dependence on imports?

India can reduce import dependence by boosting domestic manufacturing, investing in renewable energy, and promoting local industries to minimize the impact of currency fluctuations.

By staying informed about economic trends and government policies, businesses and individuals can make better financial decisions to navigate currency fluctuations effectively.